ex works shipping terms revenue recognition

Buyer is not required to disclose any export information or details regarding the export of the goods. Ex Works obliges the buyer to undertake export procedures obtaining of licences security clearances and so on The buyer may be poorly placed to do this.

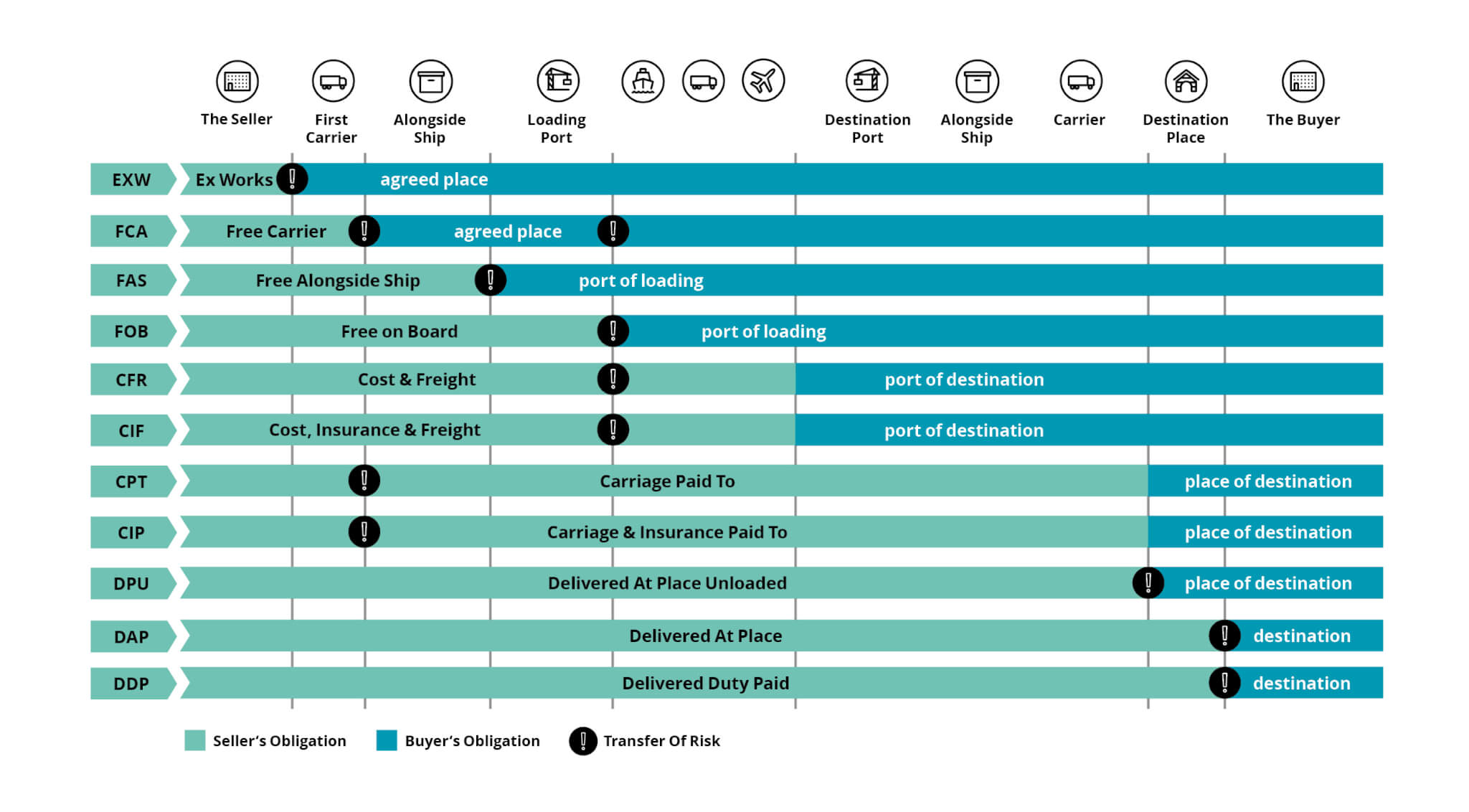

Ex Works EXW Can be used for any transport mode or where there is more than one transport mode.

/GettyImages-852075234-32b79f81641d40cfa765551fc1f35df4.jpg)

. Management must establish that it is probable that economic benefits will flow before revenue can be recognized. The Incoterms 2020 Rules. Ex works is the same as Freight on Board FOB Shipping.

This rules first version came into force in the original Incoterms 1936 and included in its heading Ex-factory ex-mill explantation ex-warehouse etc in the English section of that book with German and French translations included in the book. Revenue recognition page 39. The two terms can be used interchangeably because they assume the same terms and agreement between the buyer and seller.

The buyer must pay the price of goods as agreed in the contract of sale. Revenue is recognized when collectibility is reasonably assured. Question on revenue recognition for a month-end shipment.

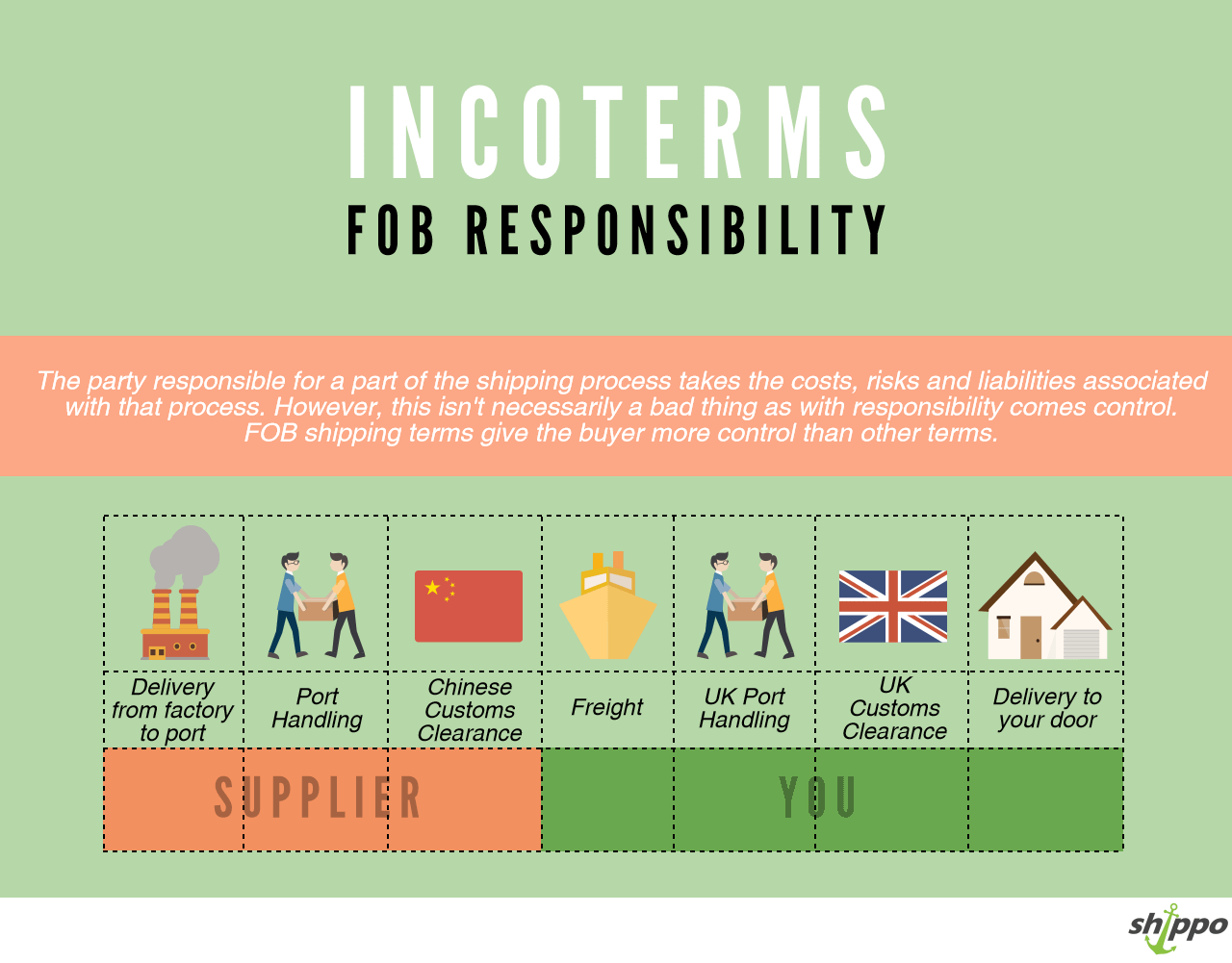

The seller must deliver the goods commercial invoice and evidence of conformity. INCO Terms and Revenue Recognition INCO Term Revenue Recognition Location Trigger Document When You Can Invoice When Risk Transfers Ex-works plants loading dock Written notification to buyer that goods are ready for pick-up upon written notification of readiness to buyer once cargo is placed at loading dock and made available to buyers trucker. Debit Cost of sales.

The buyer is responsible for loading the goods onto a vehicle. Deliver the goods at the agreed point date or period not loaded on vehicle. From the sellers perspective there is the problem of obtaining evidence that the.

A company is required to consider the underlying substance and economics of an arrangement not merely its legal form. Ex Works EXW Meaning. This rule places minimum responsibility on the seller who merely has to make the goods available suitably packaged at the specified place usually the sellers factory or depot.

Risk transfers from seller to buyer when the seller makes the good available at the sellers premises. INCOTERMS 2010 E _ Terms. Revenue recognition point.

Goods are invoiced to customers on CIFCPTDDU basis Carriage Paid To Named Place or Delivered Duty Unpaid at Named Place. When EXW is used in a contract the named place is. And according to the definition of Ex-works transportation costs and associated risks are no longer a burden for the seller.

Working with a CPA who is knowledgeable with domestic and international shipping terms as well as revenue recognition standards will help raise your awareness and. Revenue from sales of goods. At EXW the client takes the package in the ABCs warehouse and the control of goods passes to the client on 31 December 20X1.

Risk transfers from seller to buyer when the seller makes the good available at the sellers premises. This rule places minimum responsibility on the seller who merely has to make the goods available suitably packaged at the specified place usually the sellers factory or depot. Some traders like EXW because they believe it allows them to recognize revenue at the earliest possible instance.

However Incoterms do not define revenue recognition rules. We were using ExWorks as a default term for all exports EU and third country unless the customer insisted on something else. Definitions of these terms in accordance with the International Commercial terms Incoterms are listed below.

The seller is responsible for the freight and insurance if desired and title passes to the buyer. CIP Carriage and Insurance Paid Ownership transfers from the Company A to Company B when the goods have been delivered to the shipping carrier. The advantage of ex-works from a sellers standpoint is that the seller is allowed to recognize revenue once the product has been picked up or.

Ex Works EXW is an international trade term by which a seller makes the product available at a designated location and the buyer incurs transport costs. In any event the seller is only obliged to provide assistance at the buyers risk and expense. Some of the most common international shipping arrangements are Ex Works EXW Free Alongside Shipping FAS Cost Insurance and Freight CIF and Delivered Duty Paid DDP.

One of the first things I started to look at was our use of Incoterms Rules. Under these terms goods are at the sellers risk until they arrive. The sales agreement incoterm is Ex-works - sellers premises.

Ex works shipping terms revenue recognition. Ex Works EXW Incoterms can be used for all modes of transport and even when there are multiple modes of transport involved in transportation. The Incoterm that places the most responsibility on the buyer EXW or Ex Works indicates an international trade contract in which the seller has the goods ready for pickup from an agreed on location and often the sellers factory buyer is responsible for all operations including pickup export responsibilities and all.

Delivery terms. It was nonsense in my opinion especially as in more than 70 of cases our company organised and paid the international freight and sent a. The shipping terms most commonly used in contracts between the Company and the customer for delivery of capital solar equipment are FOB Ex-Works and CIP.

Major problems if used with a Letter of Credit. The customer is responsible for shipping and insurance costs and must reimburse the seller once goods are physically received at place of destination. We shipped goods to a buyer last week in December and the shipment was delivered on Jan 3rd.

A Few Quick Points. Accordingly the goods are removed from inventories and are recognized as cost of sales. There are 11 trade terms available under the Incoterms 2020 rules that range from Ex Works EXW which conveys the least amount of responsibility and risk on the seller to Delivered Duty Paid DDP which places the most responsibility and risk on the seller.

Its origin in common usages go back long. The EXW term is never involved with an AWB or OBL. Revenue recognition criteria have been met.

The journal entry is. Chart of Responsibilities and Transfer of Risk summarizes. The shipper will likely be required to present an AWB or OBL.

This is the best Incoterm to use if the buyer wants to handle everything for a shipment without sellers interference or support. The Point of Revenue recognition may change when the term of delivery is change it May be EXW Ex Work or CNF etc But the basic concept remains the same that is when the Performance obligation. Revenue recognition shipment of goods Scenario.

EXW Incoterms 2020.

Incoterms 2020 Cif Spotlight On Cost Insurance And Freight

Free On Board Fob Fob Shipping Terms Fob Meaning What Is Fob F O B Term Ie Fob Shanghai Shippo Shipping Uk China

Fob Shipping Point Meaning Example And More Financial Management Accounting And Finance Meant To Be

Revenue Recognition For Shipping Agreements Revenuehub

Incoterms 2020 Exw Spotlight On Ex Works Shipping Solutions

Free On Board Fob Fob Shipping Terms Fob Meaning What Is Fob F O B Term Ie Fob Shanghai Shippo Shipping Uk China

/GettyImages-852075234-32b79f81641d40cfa765551fc1f35df4.jpg)

Free On Board Shipping Point Vs Free On Board Destination What S The Difference

Palletization The Process Of Placing Goods Or Materials Either Packaged Or Bulk Onto Pallets The Pallet Provides A Base Corrugated Carton Pallet The Unit

New Incoterms 2020 And Their Impact On Accounting Dreport In English

What Shipping Incoterms Are And Why They Matter Fob Exw Cif

/port-4517777_1920-293aa73f31de4b62b94aaa8cd7bb0b26.jpg)

Delivered Duty Unpaid Ddu Definition

Incoterms 2020 Exw Spotlight On Ex Works Shipping Solutions

What Is The Difference Between Fob And Cif Redwood Logistics Redwood Logistics