tax return rejected dependent ssn already used

Whether the cause of this rejection is the result of a typo. File a paper return.

Dont try to e-file you wont be able to if someone else already has used the social security number.

. Web If someone has stolen your Social Security Number and filed a fraudulent tax return to receive your refund your tax filing will be rejected if you try to e-file. Web If you did not file a Federal return at all this year contact the IRS immediately at 800-829-1040 as an income tax return has been filed using the Primary Taxpayers SSN. Web Sometimes the state tax return will be accepted for efiling even when the federal return has been rejected.

Web Was your tax return rejected because your SSN was already used on another return. My 1040 was rejected with code R0000-502-001. Web If someone uses your ssn to fraudulently file a tax return and claim a refund your tax return could get rejected because your ssn was already used to file a return.

For example if your return is rejected because someone else uses your SSN your spouses SSN or. Web The SSN in question also appears as the filer spouse or dependent on another tax return for this same year. Web My tax return was rejected for dependent ssn was already used- this is my year to claim my dependent I believe my ex has claimed for this year when she is not.

If it turns out there is tax-related identity theft on your federal. I know I have not filed previously this. Web Rejected due to SSN already used.

File a paper return. File paper and the IRS will. Web If your tax return is being rejected because the listed dependents Social Security Number is being used on another tax return and you have verified that the information you have.

Web Return Rejected due to dependent social being used. SSN has been used on a previously accepted return. I submitted a client return with their dependent daughter.

The IRS may delay your refund while the IRS looks into the issue but you should still. Web The reject code is sent when the irs has already accepted a tax return with the social security number ssn that has been seen as your dependent. Whether the cause of this rejection is the result of a typo on.

Web Here is how to fix this. Web The form basically states you think you may have been a victim of ID theft and you are who you say you are and it requires that you submit a copy of your SSN and. Web If your return was rejected due to your dependents SSN being used on another return the first thing to do is to verify that you entered the SSN correctly in the return.

Web Sometimes you cant e-file a corrected return after an IRS rejection. Web The SSN in question also appears as the filer spouse or dependent on another tax return for this same year. Print out and mail your return claiming your dependent to the IRS.

Web When the IRS rejects a federal tax return because a dependents SSN or name doesnt match their records youll first want to check that you entered your dependents. Learn how to tackle this issue with information from the experts at HR Block.

Fixing Tin Ssn Validation Errors From The Irs Integrity Data

How To Fill Out A Fafsa Without A Tax Return H R Block

1040 Identity Protection Pin Faqs

Is Your Tax Return Rejected Follow These Steps To Correct It

Fraudulent Tax Return And Identity Theft Prevention Steps

What Got Your Tax Return Rejected And What You Can Do About It

What Got Your Tax Return Rejected And What You Can Do About It

What Got Your Tax Return Rejected And What You Can Do About It

Tax Id Theft Victim Get A Copy Of The Fraudulent Return Filed In Your Name Don T Mess With Taxes

Rejected Return Due To Stimulus H R Block

Tax Refund Stimulus Help I M A 23 Year Recent College Graduate Who Stupidly Applied For Stimulus Check And Later Deleted My Application From The Irs Website Because When M Facebook

Tax Return Rejection Codes By Irs And State How To Re File

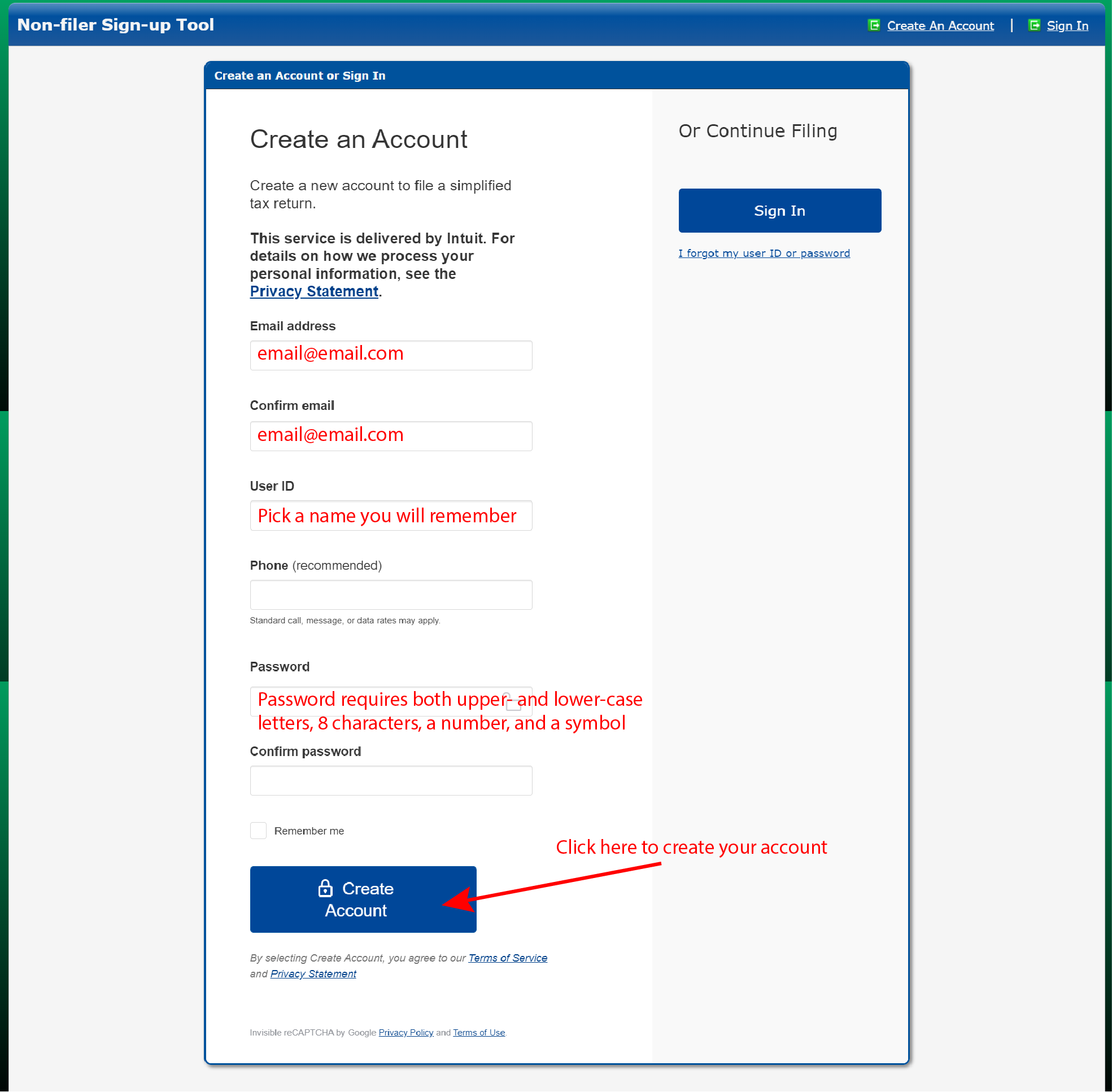

How To Fill Out The Irs Non Filer Form Get It Back

6 Times You Should Paper File Your Tax Return Dimercurio Advisors

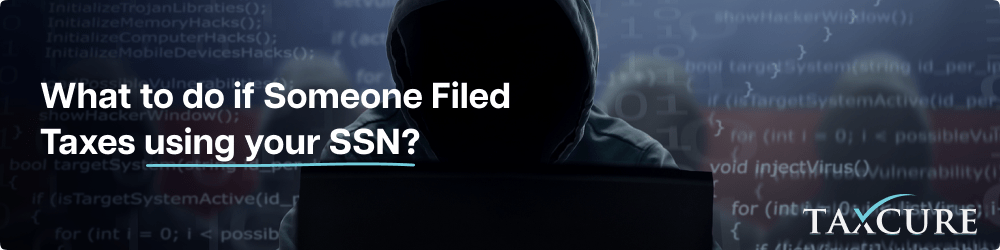

Irs Identity Theft What To Do If Someone Files Taxes Using Your Ssn

3 11 3 Individual Income Tax Returns Internal Revenue Service

Someone Used My Social Security Number To File Taxes What Do I Do

What If Irs Rejects Your Efiled 1040 Or An Extension After The Deadline Internal Revenue Code Simplified